Did you know it takes 957 gallons of water to create a single Big Mac? Some 550 million Big Macs are consumed each year in the US alone. That’s a lot of water. But we simply wouldn’t have Big Macs without the infrastructure to filter and transport water to each part of the Big Mac production process.

It’s easy to forget that infrastructure is a vital cog in the items we consume every day in a dynamic and growing economy. Infrastructure is often viewed as old and boring, dangerous when rates rise, and relatively volatile.

But if we can deconstruct the three most pervasive and misleading myths around global listed infrastructure, investors, particularly retirees, will be less likely to dismiss an asset class that delivers them two powerful benefits: a defensive and stable yield for income, and also the capital growth needed to keep up with their rising costs of living.

MYTH 1: Infrastructure is a boring old-economy style investment

The first myth is that somehow in a world of Amazon, Uber and Google infrastructure is an ‘old economy’ style investment; it has little growth potential and limited relevance to future economic needs.

Nothing could be further from the truth. Indeed, McKinsey estimates that US$57 trillion will be spent on infrastructure worldwide by 2030. And infrastructure is at the core of many key global secular themes that are shaping the future of investment markets:

-

Communication and data usage. Our ability to deliver and enable the technology and communication needs for the new economy relies on infrastructure. Global mobile data traffic is expected to increase seven-fold between 2016 and 2021, according to CISCO.

-

Shale gas. Drillers have used fracking technologies to extract new sources of natural gas from previously uneconomic shale formations. That natural gas is helping meet the insatiable global demand for energy. We require some $A641 billion of investment in midstream energy infrastructure through to 2035, an annual spend of $A29 billion.

-

Electricity production and transmission. The production and delivery of an economic electricity supply will become increasingly important if we are to maintain global economic growth.

-

Water. Our ability to store and efficiently deliver a reliable water supply is becoming increasingly vital as the world’s population surges and global water distribution remains unpredictable. Agriculture currently uses around 70-80% of available water. That usage will rise as developing economies, such as China, increase consumption of meat, which requires significant volumes of water to produce. Indeed, some forecasts say that, by the year 2030, the global demand for water will exceed the global supply of water by an astounding 40%.

MYTH 2. Volatility in listed infrastructure is a disadvantage compared to unlisted infrastructure

A myth also persists that because global listed infrastructure (which can be bought and sold on exchanges) can be more volatile, it is therefore a worse investment than unlisted infrastructure.

Yes, unlisted infrastructure can be less volatile because assets are typically valued twice a year. But listed infrastructure’s daily pricing creates opportunity. An active manager can find arbitrage opportunities when economic growth slows and the value of listed infrastructure falls faster and more than unlisted assets.

Listing infrastructure on an exchange brings other benefits to investors, including diversification. Investors can access a broad set of liquid investment opportunities across geographies and sectors that may not be available through direct investment.

We believe that, ultimately, the returns from infrastructure are determined by the asset itself, and not by whether the asset is in the listed or unlisted format. In many cases, listed infrastructure companies and direct investors co-own assets and as a result, both formats should deliver similar returns in the long term.

MYTH 3. Infrastructure assets are susceptible to rate hikes

But perhaps the most pervasive myth is that infrastructure suffers when central banks increase interest rates. But the reality is that infrastructure assets typically provide protection against rising interest rates.

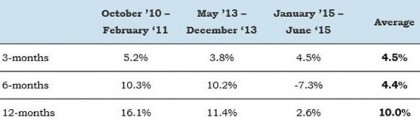

As we’ve noted previously, global listed infrastructure is sensitive to rate rises in the short-term. Since the end of the GFC, we have witnessed 4 periods of meaningful increases in sovereign yields. Global listed infrastructure initially underperformed global equities, but then, as you can see in the chart below, the asset class showed remarkable resilience and recovered all the relative underperformance over the next 12 months.

Table 1. Relative performance following periods of rising yields – Global Listed Infrastructure vs. Global Equities

Why is infrastructure rate rise resilient? Firstly, infrastructure companies’ longer-term debt structures gives them the option to refinance longer-term debt at favourable rates should market conditions allow. Secondly, when rates rise, infrastructure companies can often charge customers more because contracts and regulation are often negotiated on a ‘cost-plus’ basis. And thirdly, when interest rates rise because of GDP growth, infrastructure assets are usually benefiting from increased demand in a buoyant economy.

Over the long term, investors should focus on global listed infrastructure’s ability to generate visible and growing cash flow, because that is ultimately what determines performance, not fluctuating rates.

A different story

More than ever investors, particularly retirees, need both stable income and growth, which is exactly what global listed infrastructure delivers.

Yet it is an asset class that is particularly prone to distorting myths, perhaps because it is relatively new. That creates a danger that investors don’t include it in their long-term portfolios.

But global listed infrastructure will continue to deliver income and growth, even as quantitative easing (QE) ends and interest rates rise, because of its strong cash flows and because it is the foundation of improving global growth.

People will still be eating Big Macs, and we’ll still need the gallons of water required to make the hamburgers, and most importantly we’ll still need the infrastructure that delivers that water.

Source: AMP Capital 14 December 2017