The post-GFC world of record low rates and quantitative easing (QE) created many ‘fashionable’ asset classes that outperformed, such as yield plays and defensive growth stocks including big tech companies like Amazon.

But almost ten years on from the GFC we are now shifting to a new macro environment as central banks like the US Federal Reserve make it clear they are shifting from QE to QT (quantitative tightening).

There is a danger, however, that investors fail to react to the emergence of this new regime, and they get trapped in crowded ‘overly fashionable’ asset classes and expose their portfolio to significant damage when these assets are sold off.

To avoid becoming ‘fashion victims’, in our view investors and advisers should be flexible and begin moving to assets that will outperform relatively as the global economy improves and central banks shrink their balance sheets. But they will also need to hedge against an increase in market volatility as the QE cushion is removed.

The good news is the shift to a new investment regime is throwing up some good opportunities, including high-conviction sector ideas like energy and financials.

1. A move to cyclicals

The first major change investors may consider is altering equities allocations.

Four years ago, we wanted to chase yield and were focused on REITs and other assets such as high-yield credit. But we have now moved a notch up in the economic cycle and shifted to a phase where global economic growth is becoming more sustainable and synchronised.

Therefore, we see value in increasing allocations to cyclical stocks such as energy, financials, materials, industrials and transportation stocks. We believe real assets such as commodities, metals and energy should also do particularly well, and our Dynamic Markets Fund, including the Active ETF DMKT, has a high – 10 per cent – allocation to commodities.

Within cyclicals and commodities, energy is emerging as a ‘high-conviction’ idea as the sector’s fundamentals move from ‘bad’ to ‘less bad’, creating a window of opportunity before most investors catch on.

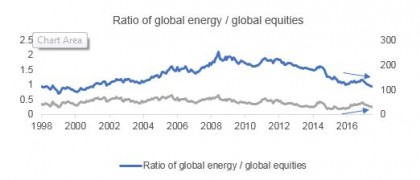

Source: AMP Capital

The chart above shows a massive disconnect between the relative performance of energy stocks and the rest of the market. Global energy stocks have also lagged a rise in oil prices. No one believes oil prices will stay high because inventories are high.

But, if you look closely, yes inventories are high, but they are coming down at a rapid pace. US shale oil production, a major cause of oil inventories rising, is clearly declining. New wells are interfering with old ones, and producers need to dig a lot more wells to keep productivity at the same levels.

We believe oil prices are heading higher. Valuations are very cheap, and because there is a lot of pessimism the market is not seeing energy fundamentals get ‘less bad’.

2. Financials – winners from shrinking balance sheets

The second major change investors need to adapt to is the impact of Central Banks’ moves to shrink balance sheets on the relative performance of asset classes.

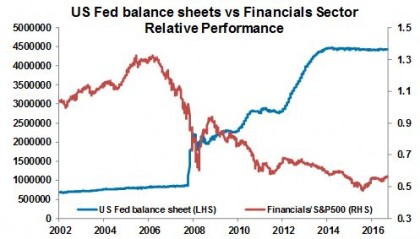

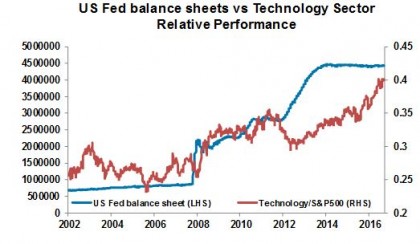

Source: Bloomberg. Past performance is not a reliable indicator of future performance.

Central banks play a major role in the relative performance of asset classes. The chart above shows that as central banks expanded their balance sheet (the rising blue line) the tech sector (defensive growth) outperformed, but the financial sector suffered.

But as we move from QE to QT and that blue line starts coming down, that relative performance is likely to reverse and banks will perform relatively well.

We have an allocation to European and Japanese banks through ETFs because they were the most negatively affected financials during QE because interest rates there fell. Banks had massive amounts of excess reserves. They put those reserves with central banks and earned negative interest rates, damaging their profitability.

That underperformance means European and Japanese banks should have the most upside in QT.

3. Hedging volatility and uncertainty

But investors also need to adapt to a likely increase in volatility.

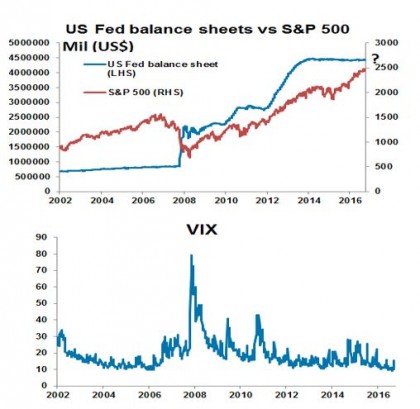

Source: Bloomberg

As you can see in the charts above, QE supressed volatility. Every time news became bad, markets would go up because there was an increased possibility Central Banks would ease again.

That lack of volatility means markets have become complacent. Markets are not pricing in a lot of uncertainty. US equities, for example, haven’t corrected for the past year and every correction gets bought into. (US equities are the most expensive in the world, so we are underweight.)

With markets not pricing in uncertainty, we have a high, 30 per cent allocation to cash. When the market does price uncertainty and corrects we can use that cash to re-enter.

Because QE dampened volatility, when it ends and central banks shift to QT we will therefore see upward pressure on volatility with a greater risk of corrections and setbacks. Investors should therefore consider hedging their portfolio.

One option is the $US. Given the negative sentiment against the $US – a massive turnaround since the start of the year – the $US has become a great hedge if portfolios correct. Our Dynamic Markets Fund is long $US against short positions in emerging markets currencies. (EM currencies are also a good hedge in case of war.)

Another possible hedge is gold. The probability of a nuclear war with North Korea might be low, but if it does happen the impact will be very high. One asset class that does well in every geopolitical tension or war in the past has been gold. If things escalate from here, gold prices are likely to multiply several fold. The Dynamic Markets Fund also has a 3 per cent allocation to gold as a tail hedge.

The benefits of multi-asset investing

Loyalty, monogamy and trust are principles of life. But in investing those principles work against you.

Like fashion, asset classes go in and out of vogue. In 2000 tech stocks were fashionable. In 2007, housing-related stocks in the US were. In 2010 resource stocks. And now yield plays and big tech stocks like Amazon are fashionable.

But their performance has run its course, and as we move to a new macro environment and investment regime it’s time to look at shifting other assets.

In this complex regime shift, investment strategies like multi-asset investing — the strategy used to manage the Dynamic Markets Fund and DMKT – will thrive. Multi-asset investing gives us the flexibility and scope to change allocations depending on where we are in the cycle. And it also provides us with a disciplined process so we can find value, filter noise and remain objective.

Multi-asset investing allows us to stay away from the crowd and look at opportunities which are underappreciated. It allows us to be ‘fashionable’ but not end up as ‘fashion victims’. Investors and advisers need to follow that lead.

For information on listed investments including Active ETFs and DMKT, register for our upcoming webinar.

Source: AMP Capital 12 October 2017

Author: Nader Naeimi

Nader Naeimi has more than 19 years of experience in Australia’s financial markets, including 16 years at AMP Capital. As the Head of Dynamic Markets, he is responsible for leading the Dynamic Asset Allocation strategy for the Multi-Asset Group, as well as other macro strategies and asset allocations for several AMP Capital funds.

This article has been prepared by AMP Capital Investors Ltd (ABN 59 001 777 591, AFSL 232497) (“AMP Capital”). BetaShares Capital Ltd (ACN 139 566 868, AFSL 341181 (“BetaShares”) is the responsible entity and the issuer of units in the AMP Capital Dynamic Markets Fund (Hedge Fund. AMP Capital is the investment manager of the Fund and has been appointed by the responsible entity to provide investment management and associated services in respect of the Fund. Investors should consider the Product Disclosure Statement (PDS) for the Fund before making any decision regarding the Fund. The PDS contains important information about investing in the Fund and it is important investors read the PDS before making a decision about whether to acquire, continue to hold or dispose of units in the Fund. Neither BetaShares, AMP Capital, nor any other company in the AMP Group guarantees the repayment of capital or the performance of any product or any particular rate of return referred to in this information.

Past performance is not a reliable indicator of future performance.

While every care has been taken in the preparation of this information, BetaShares and AMP Capital make no representation or warranty as to the accuracy or completeness of any statement in it including without limitation, any forecasts. This content has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. Investors should, before making any investment decisions, consider the appropriateness of this information, and seek professional advice, having regard to their objectives, financial situation and needs.