Introduction

Every so often shares go through rough patches. We saw this most recently around February on the back of US inflation and interest rate concerns and the start of US tariffs which saw US shares and global shares fall roughly 10% and Australian shares fall 6%. Shares mostly recovered – even getting through the seasonally weak months of August and September surprisingly well – with US shares making new records and Australian shares hitting a ten-year high, but the worry list has returned again with US, global shares and Australian shares now down around 7% from their recent high. This note looks at the issues for investors and puts the falls into context.

What’s driving the latest plunge?

The recent plunge reflects a range of factors.

-

Investors have started to worry again that the very strong US economy will push the Fed into tightening a lot more and that this will cause a further sharp rise in bond yields which will threaten growth and share market valuations.

-

The trade conflict between the US and China is continuing to intensify and spilling over into other areas.

-

Technology shares, which have been key drivers of the US share markets rally (and outperformance) have been vulnerable – being somewhat overvalued and facing increased regulation in the US (which is something that President Trump has been threatening).

-

Rising oil prices due to strong global demand and threats to supply have added to concerns about inflation and growth.

-

Problems in the emerging world partly due to rising US interest rates poses a threat to global growth as reflected in a recent downgrade to the IMF’s global growth forecasts.

-

Nervousness remains in the US around President Trump and the Mueller inquiry and the upcoming US mid-term Congressional elections.

-

Tensions in the Eurozone regarding the Italian budget are weighing on European shares.

-

October is also known for share market volatility and this October is the 31st anniversary of the 1987 crash which often seems to create a bit of apprehension.

Because shares have fallen rapidly they are technically oversold and so could have a short-term bounce. But given that many of these issues could get worse before they get better the risk is that the pullback has further to go.

Considerations for investors

Sharp market falls with headlines screaming that billions of dollars have been wiped off the share market (funny that you never see the same headlines on the way up!) are stressful for investors as no one likes to see the value of their investments decline. However, several things are worth bearing in mind:

First, periodic corrections in share markets of the order of 5-15% are healthy and normal. For example, during the tech/dot. com boom from 1995 to early 2000, the US share market had seven pull backs greater than 5% ranging from 6% up to 19% with an average decline of 10%. During the same period, the Australian share market had eight pullbacks ranging from 5% to 16% with an average fall of 8%. All against a backdrop of strong returns every year. During the 2003 to 2007 bull market, the Australian share market had five 5% plus corrections ranging from 7% to 12%, again with strong positive returns every year. More recently, the Australian share market had a 10% pullback in 2012, an 11% fall in 2013 (the taper tantrum), an 8% fall in 2014, a 20% fall between April 2015 and February 2016 and a 7% fall earlier this year all in the context of a gradual rising trend. And it has been similar for global shares, but against a strongly rising trend. See the next chart. While they can be painful, share market corrections are healthy because they help limit a build-up in complacency and excessive risk taking.

Source: Bloomberg, AMP Capital

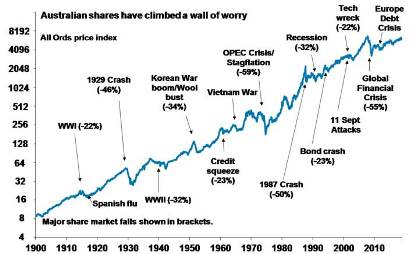

Related to this, shares climb a wall of worry over many years with numerous events dragging them down periodically, but with the long-term trend ultimately up & providing higher returns than other more stable assets. Bouts of volatility are the price we pay for the higher longer-term returns from shares.

Source: ASX, AMP Capital

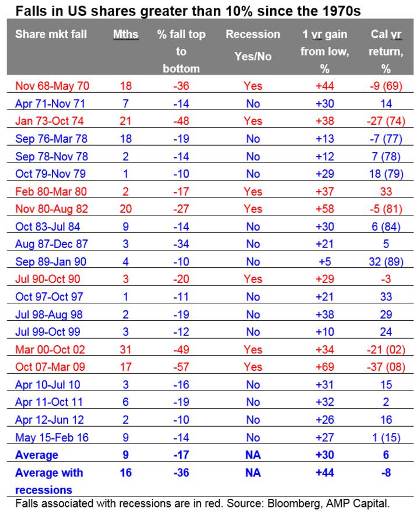

Second, the main driver of whether we see a correction (a fall 5% to 15%) or even a mild bear market (with say a 20% decline that turns around relatively quickly like we saw in 2015-2016) as opposed to a major bear market (like that seen in the global financial crisis (GFC)) is whether we see a recession or not – notably in the US. The next table shows US share market falls greater than 10% since the 1970s. I know it’s a bit heavy – but I like this table! The first column shows the period of the fall, the second shows the decline in months, the third shows the percentage decline from top to bottom, the fourth shows whether the decline was associated with a recession or not, the fifth shows the gains in the share market one year after the low and the final column shows the decline in the calendar year associated with the share market fall. Falls associated with recessions are highlighted in red. Averages are shown for the whole period and for falls associated with recession at the bottom of the table.

Several points stand out. First, share market falls associated with recession tend to be longer and deeper. Second, falls associated with recessions are more likely to be associated with negative total returns (ie capital growth plus dividends) in the associated calendar year as a whole. Finally, as would be expected the share market rebound in the year after the low is much greater following falls associated with recession.

So whether a recession is imminent or not in the US is critically important in terms of whether we will see a major bear market or not. In fact, the same applies to Australian shares. Our assessment remains that US/global recession is not imminent:

-

Still high levels of business and consumer confidence globally are only just starting to help drive stronger consumer spending and business investment.

-

While US monetary conditions have tightened they are far from tight and they are still very easy globally and in Australia (with monetary tightening still a fair way off in Europe, Japan and Australia). We are a long way from the sort of monetary tightening that leads into recession.

-

Fiscal stimulus will boost US growth into next year, partly offsetting Fed rate hikes.

-

We have not seen the excesses – in terms of debt growth, overinvestment, capacity constraints and inflation – that normally precede recessions in the US, globally or Australia.

Reflecting this, global earnings growth is likely to remain reasonable providing underlying support for shares. So, for all these reasons its likely that the current pull back is more likely to be a correction rather than a major bear market.

Third, selling shares or switching to a more conservative investment strategy or superannuation option after a major fall just locks in a loss. With all the talk of billions being wiped off the share market, it may be tempting to sell. But this just turns a paper loss into a real loss with no hope of recovering.

Fourth, when shares and growth assets fall they are cheaper and offer higher long-term return prospects. So, the key is to look for opportunities the pullback provides. It’s impossible to time the bottom but one way to do it is to average in over time.

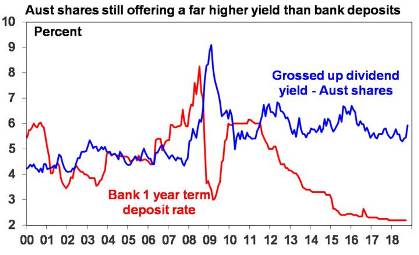

Fifth, while shares may have fallen, dividends from the market haven’t. So the income flow you are receiving from a well-diversified portfolio of shares remains attractive, particularly against bank deposits.

Source: RBA, Bloomberg, AMP Capital

Sixth, shares and other related assets often bottom at the point of maximum bearishness, ie just when you and everyone else feel most negative towards them. So the trick is to buck the crowd. “Be fearful when others are greedy. Be greedy when others are fearful,” as Warren Buffett has said.

Finally, turn down the noise. At times like this, negative news reaches fever pitch. Talk of billions wiped off share markets and warnings of disaster help sell copy and generate clicks and views. But such headlines are often just a distortion. We are never told of the billions that market rebounds and the rising long-term trend in share prices adds to the share market. Moreover, they provide no perspective and only add to the sense of panic. All of this makes it harder to stick to an appropriate long-term strategy let alone see the opportunities that are thrown up. So best to turn down the noise and chill out – yeah, I agree it’s sometimes easier said than done, but still!

Source: AMP Capital 12th October 2018

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.