Expectation for future returns are being shaped by prospects of muted asset class returns, higher risks, and elevated market valuations. In addition, because of technology advancement and improved company disclosures we are seeing alpha opportunities being arbitraged away for many asset classes around the world.

We think investors looking to achieve their investment goals over the next decade could consider diversifying their exposure to niche asset classes that offer sustained high capital growth potential with idiosyncratic exposures that are less correlated to other asset classes.

In our view, Australian small caps offer investors the following characteristics:

-

High earnings/return potential and greater idiosyncratic exposure as compared to other equity asset classes

-

A large opportunity set of stocks in an inefficient market which offers an attractive return delivery for successful small cap stock pickers

-

Small companies offer leadership in innovation that has the potential to transform industries and deliver significant capital appreciation

-

Investment fundamentals in Australian small caps look more attractive relative to other market segments, supported by structural growth stories, both domestically and offshore

We believe Australian small caps ticks many of the boxes investors are looking for and exposure to this asset class is worth considering as part of a diversified portfolio.

High return potential in a low return environment

We believe the strong market returns generated over the last decade, which have been largely driven by central bank policies resulting in lower global interest rates and elevated market valuations, may be more difficult to achieve going forward with the prospect of lower asset class returns and higher risks.

In a low return environment, investors need to ask whether their existing investment strategy will achieve their return targets going forward. Equities are traditionally a key source of high returns and capital growth, but will this continue to be the case and are all equity markets equal when it comes to meeting the demands for capital growth? Investors are strongly motivated by the need to seek out new sources of capital appreciation outside of traditional beta exposures to meet their investment objectives going forward.

Over the long-term, an allocation to Australian small caps via active management has delivered strong capital appreciation and returns in excess of many other equity classes.

Past performance is not a reliable indicator of future performance. Source: eVestment, March 2020. Note: The chart shows the cumulative performance for the median US large cap manager, median US small cap manager, median Global ex-US large cap manager, median Global ex-US small cap manager, median Australian large cap manager and median Australian small cap manager, respectively.

In summary, an allocation to Australian small caps we think may offer investors high return potential.

High earnings growth potential

Exposure to select Australian small companies have a track record of offering higher earnings growth relative to their large cap counterparts and other equity classes. Key reasons include greater exposure to emerging thematics that have accelerated growth profiles, in addition to higher upside earnings leverage given typical low industry market shares and cost structures. Many small companies look to increase market share from low levels, even during challenging market conditions, which can lead to significant earnings and valuation upside over the long-term.

We believe there is a strong correlation between companies that can deliver strong medium-term earnings growth to share price performance which puts Australian small caps in an enviable position relative to many other equity asset classes.

One of the last remaining inefficiently priced segments of the market

The ability for investors to consistently exceed market/benchmark returns is becoming increasingly challenged with advances in technology, smarter information systems employed by the investment community and improved company disclosures are contributing to a greater degree of market efficiency leaving fewer niche markets left to exploit. This is particularly evident in US large caps where investment managers have consistently struggled to outperform their respective benchmarks.

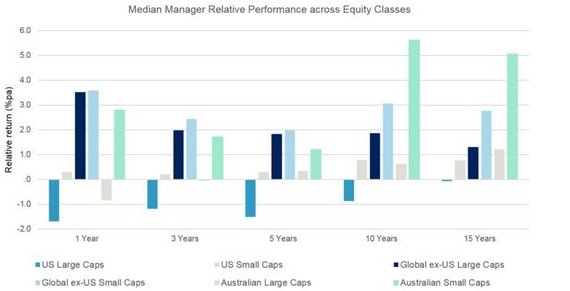

The ability for investment managers to beat their respective benchmark performance (commonly known as relative return or alpha) in niche markets like Australian small caps has been consistent and has delivered significantly higher alpha as compared to other equity classes over the long-term (over 10 to 15 year periods).

Past performance is not a reliable indicator of future performance. Source: eVestment, March 2020.

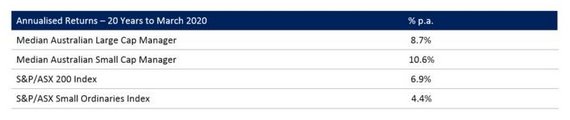

Over the long-term, the Australian large cap market (S&P/ASX 200 Index) has outperformed the small caps market (S&P/ASX Small Ordinaries Index) which is an anomaly when compared to many offshore markets. This is particularly interesting given the large cap index is dominated by banks and diversified miners which has substantially outperformed the small cap index which has recently contained material exposure to stocks that have captured investor’s attention over the past few years including technology, Chinese consumer consumption (e.g. infant formula and vitamins), electric vehicles and gold.

More importantly though is the median small cap manager has significantly outperformed not only the small caps index, but also the large cap index and the median large cap manager over a long time period. Investors who have trusted their money with even a middle of the pack small cap manager have seen strong compound returns over this period.

Past performance is not a reliable indicator of future performance. Source: eVestment, March 2020.

Past performance is not a reliable indicator of future performance. Source: eVestment, March 2020.

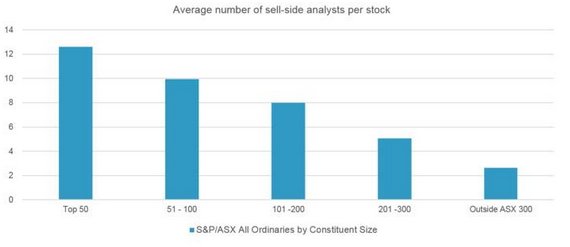

The Australian small cap manager outperformance has been driven by a high degree of market inefficiency which has provided significant opportunities for investors to exploit pricing anomalies. The elevated market inefficiency experienced has been driven by multiple factors, including:

-

Sell-side analyst coverage drops off down the market capitalisation spectrum, notably outside the S&P/ASX 100 Index (see chart below)

-

Small companies can attract lower institutional investment and therefore a less sophisticated investor base, notably smaller companies outside the top 200 listed companies

-

News flow (as measured by average number of news articles Bloomberg published per day) is typically lower/less frequent for small companies

-

Small companies typically have larger movements around news flow and result announcements

-

Many quantitative factor returns are magnified in small caps, notably price, earnings and quality factors

Source: Factset, April 2020

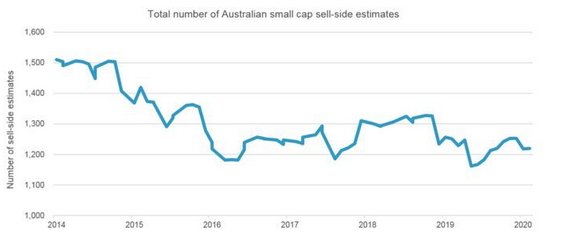

Interestingly, we believe many of these factors highlighted above will be exacerbated (rather than reduced) for Australian small companies going forward given increasing passive investment and recent changes to stock research which has seen a dramatic reduction in coverage of small cap stocks by sell-side analysts.

Source: Factset, April 2020

We believe this provides significant opportunities for fundamental based investors to continue to add value via rigorous company and industry research.

Emerging thematic exposure

Many large cap companies are ‘old world’ being mature businesses within lazy duopoly industry structures which are facing potential disruption and run the risk of being left behind in a fast-changing modern world.

How do investors gain access to emerging growth sectors and themes?

An allocation to Australian small caps we think provides exposure to exciting growth areas, including niche market segments and emerging thematics that are yet to be fully appreciated by the broader market. Small companies tend to be more focused (one market or product) or operate in niche sectors, including:

-

Technology – solutions provided by technology and innovation that solve the challenges of the rapid cycle of obsolescence in addition to businesses and consumer preferences – these companies provide attractive potential for growth and above-average profitability e.g. cloud computing, internet of things, 5G, data usage and software

-

Structural growth – offer sustainable growth and earnings backed by real cash flows in niche industries that are unaffected by global macroeconomic conditions – typically low market penetration in fragmented industries with a quality bias e.g. China consumption, education and ageing demographics

We see Australian small caps offering investors early-stage exposure to many of these emerging thematics that can deliver super-normal returns. A recent example is the recent strong performance of a cohort of ASX listed technology companies known as the WAAAX stocks (Wisetech, Afterpay, Altium, Appen and Xero). These companies started off as Australian small caps and many have since migrated to being large caps. The WAAAX stocks have delivered stellar returns which are well in excess of the FAANG stocks (the five prominent American technology companies being Facebook, Amazon, Apple, Netflix and Alphabet – formerly known as Google).

Past performance is not a reliable indicator of future performance. Source: Factset, April 2020.

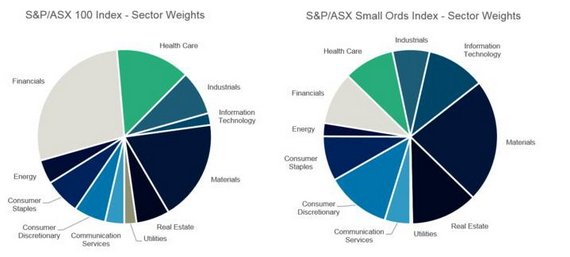

Diversification benefits

As compared to the Australian large cap market, the small caps market offers investors a greater level of sector diversification and idiosyncratic exposures. The small cap market offers a more balanced exposure to industries when compared to the large cap market which is heavily weighted towards the Financials sector.

Source: Factset, April 2020

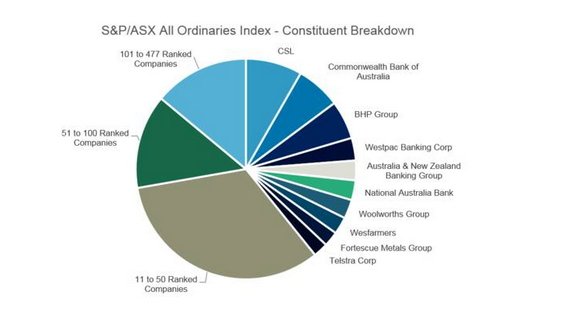

In addition, investing in small companies we think offers a significantly increased stock opportunity set to add value – the top 100 stocks represent 86% of the S&P/ASX All Ordinaries by market capitalisation but 79% of stocks by number are outside the top 100 stocks.

Source: Factset, April 2020

Worth considering

In summary, we believe Australian small caps offer investors exposure to companies that offer leadership in innovation that has the potential to transform industries and deliver significant capital appreciation. The asset class offers what we see are unique idiosyncratic exposures, a large opportunity set of stocks and in an inefficient market which can provide attractive return delivery for successful small cap stock pickers. An exposure to this asset class may be considered as part of a diversified portfolio.

Please contact us on 1300 181 707 if you seek further assistance on this topic.

Author: Phillip Hudak BBus, CFA Co-Portfolio Manager (Australian Small Caps) Sydney, Australia

Source: AMP Capital 29 May 2020

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital

Important notes: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. The information in this document contains statements that are the author’s beliefs and/or opinions. Any beliefs and/or opinions shared are as at the date shown and are subject to change without notice. This document is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.