by Diana Mousina

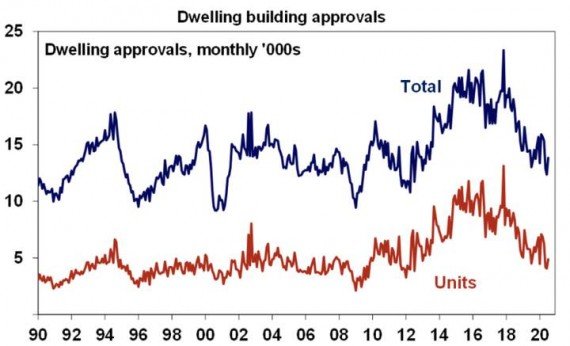

Building approvals in Australia surged by 12% in July, up 6.3% compared to a year ago. This was a much stronger result than consensus expectations of a fall in the order of 2%, and follows a run of better than anticipated numbers since April’s low point.

As an important leading indicator of national construction activity, and with implications for the lending sector as well, this is something of an encouraging sign for economic growth over the coming quarter. That said, approvals are still well below their pre-COVID levels, which were already declining before the pandemic hit our shores.

The outperformance was led in large part by multi-density approvals (such as, apartments), which rose by more than 20%, against 8% for house approvals. Non-residential building data remains extremely volatile, with the value of approvals down by 19.8% in the June quarter, on the heels of a 20.7% rise in the prior month. Looking through this monthly volatility, the trend for last few months shows a demonstrable weakening.

Source: ABS, AMP Capital

Construction contributes about 8% of Australian GDP1, and the sector’s woes were responsible for 0.6% of the country’s contraction in gross value added through the June quarter2. A sustained recovery construction would be positive news for Australia’s path out of recession, but there are a number of complicating factors.

First, restrictions on movement in Melbourne will continue to constrain the number of workers on construction sites in that city over the next few months at least, and potentially delay the entry of new projects into the pipeline. It’s worth noting that the July approval numbers pre-date Victoria’s state of disaster declaration and further tightening of COVID-19 restrictions at the beginning of August.

Second, drastically lower migration rates are dampening demand for housing and will likely affect investment in the sector whilst our international borders remain closed.

Third, consumer and business confidence will be tested by eventual shifts in unemployment that will accompany the phase-out of government assistance packages in 2021, and flow-on effects to investment in construction projects are entirely possible.

Weighing against each of these factors will be the effectiveness of the government’s HomeBuilder program, which was designed to stimulate residential construction, and which should benefit alterations and approvals construction in particular, which fell by 1.1% in July.

1 https://www.rba.gov.au/education/resources/snapshots/economy-composition-snapshot/

2 https://www.afr.com/policy/economy/australia-s-recession-in-five-graphs-20200902-p55rkw

Author: Diana Mousina, Economist – Investment Strategy & Dynamic Markets, Sydney Australia

Source: AMP Capital 15 September 2020

Reproduced with the permission of the AMP Capital. This article was originally published at AMP Capital

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.