Infrastructure is vital to economic growth. It creates a virtuous, never-ending cycle: investment in infrastructure helps stimulate sustainable long-term economic growth which then creates a further need for infrastructure. One of the current developments that is driving further infrastructure investment is the global trend towards decarbonisation to reduce CO2 emissions, and the role of energy infrastructure in fulfilling future global energy needs.

The world is moving towards a low-carbon economy. Countries around the world such as Canada, France, Germany and the UK, have announced coal phase-out plans, and the pipeline of new build coal plants has been shrinking worldwide. However, as the world economy continues to grow, with billions of people shifting into the growing middle class in the developing world, naturally global energy demand is expected to rise as well.

Meeting China’s natural gas demand

China represents a great case study, as their focus on reducing carbon emissions has seen them become the world’s largest gas importer according to Shell1.

Coal-to-gas switching has resulted in

-

78% improvement in Beijing winter air quality in the last five years

-

176 million tonne reduction in CO2 emitted by Beijing and surrounding areas (to put this into context, this is equivalent to 37 million cars off the road!)

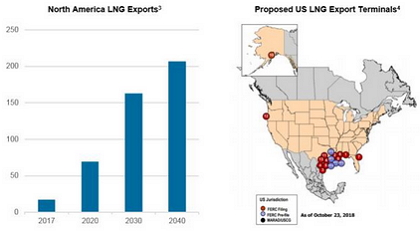

However, growth in domestic production and pipeline gas appears to be insufficient to keep pace with demand, and LNG imports are expected to increase by more than 11% per annum to 2025 according to a J.P Morgan report2. We believe this growth to be a key driver of natural gas infrastructure development in North America as LNG exports are forecasted triple over the next two decades.

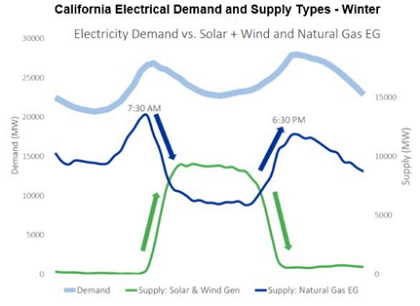

Additionally, given the intermittency of renewable energy sources and the relative clean attributes of natural gas among fast-start fuel sources, the two are viewed as important and complementary components of the energy mix going forward. As the chart below depicts, in California natural gas electric generation quickly responds to the rapid changes in renewable energy generation in order to meet demand.

Source: Sempra Energy, California Independent System Operator (CAISO) as at Feb 2019

In fact, California has recently announced an ambitious goal to only rely on zero-emission energy sources for its electricity by 2045. In order to reach this target critical infrastructure upgrades for electric utilities are required, such as increasing deployment of energy storage to enable a carbon-free future and modernising the grid to manage increasingly complex power flows.

Other states in the US and countries around the world also have ambitious carbon reduction targets and as a result we expect renewables to play an increasingly significant role in the global energy system. According to BP5 it is set to grow faster than any fuel in history. Further investment in electric utility infrastructure will be required, but also further gas infrastructure to meet the challenge of providing low carbon energy that is reliable.

If you would like to discuss any of the issues raised in this article, please call on 1300 181 707 or email support@hellowealth.com.au.

1 Shell LNG Outlook 2019 https://www.shell.com/energy-and-innovation/natural-gas/liquefied-natural-gas-lng/lng-outlook-2019.html

2 J.P. Morgan 2018 Global LNG Analyzer report

3 Source: BP Energy Outlook 2019

4 Source: FERC as at 23 October 2018. PROPOSED TO FERC Pending Applications: 1. Pascagoula, MS: 1.5 Bcfd (Gulf LNG Liquefaction) (CP15-521) 2. Cameron Parish, LA: 1.41 Bcfd (Venture Global Calcasieu Pass) (CP15-550) 3. Brownsville, TX: 0.55 Bcfd (Texas LNG Brownsville) (CP16-116) 4. Brownsville, TX: 3.6 Bcfd (Rio Grande LNG – NextDecade) (CP16-454) 5. Brownsville, TX: 0.9 Bcfd (Annova LNG Brownsville) (CP16-480) 6. Port Arthur, TX: 1.86 Bcfd (Port Arthur LNG) (CP17-20) 7. Jacksonville, FL: 0.132 Bcf/d (Eagle LNG Partners) (CP17-41) 8. Plaquemines Parish, LA: 3.40 Bcfd (Venture Global LNG) (CP17-66) 9. Calcasieu Parish, LA: 4.0 Bcfd (Driftwood LNG) (CP17-117) 10. Nikiski, AK: 2.63 Bcfd (Alaska Gasline) (CP17-178) 11. Freeport, TX: 0.72 Bcfd (Freeport LNG Dev) (CP17-470) 12. Coos Bay, OR: 1.08 Bcfd (Jordan Cove) (CP17-494) 13. Corpus Christi, TX: 1.86 Bcfd (Cheniere – Corpus Christi LNG) (CP18-512). Projects in Pre-filing: PF1. Cameron Parish, LA: 1.18 Bcfd (Commonwealth, LNG) (PF17-8) PF2. LaFourche Parish, LA: 0.65 Bcfd (Port Fourchon LNG) (PF17-9). PF3. Sabine Pass, LA: NA Bcfd (Sabine Pass Liquefaction) (PF18-3). PF4. Galveston Bay, TX: 1.2 Bcfd (Galveston Bay LNG) (PF18-7). PF5. Plaquemines Parish, LA: 0.9 Bcfd (Pointe LNG) (PF18-8)

5 BP Energy Outlook https://www.bp.com/en/global/corporate/energy-economics/energy-outlook/demand-by-fuel/renewables.html

Author: Joseph Titmus, Portfolio Manager/Analyst, Global Listed Infrastructure, Sydney, Australia

Source: AMP Capital 17 June 2019

Important notes: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) (AMP Capital) makes no representation or warranty as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs.

This document is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.