Manufactured housing is a very resilient asset class – as showcased by the largest US operator Equity LifeStyle Properties growing its net operating income every single quarter going back to the late 1990s, including during the global financial crisis1, and today the investment proposition is even more attractive.

Shipments of new manufactured houses have grown by 60 per cent over the past five years, and prices rose sharply through the first three quarters of 2018 whilst prices for site-built homes remained stagnant2.

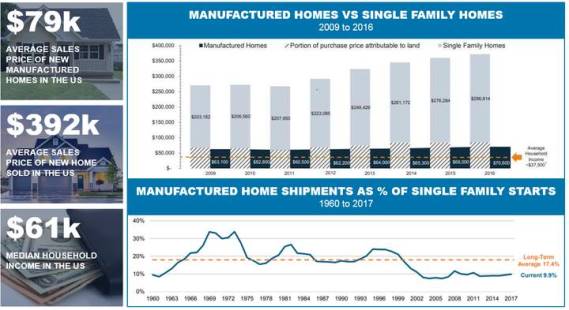

Affordability is a key factor in this resurgence. Ten years ago, 75 per cent of American houses sold for less than US$300,000. Today less than half of sales fall under that benchmark3. In contrast, the average price for a new manufactured home is less than US$80,0004. This is especially attractive to so-called ‘snowbirds’ looking to migrate from Canada and the northern states and relocate to warmer climates, a phenomenon that is accelerating as the population ages.

And as baby boomers continue to retire over the next twenty years, the manufactured housing market that focuses on age-restricted parks is set for unprecedented strong demand.

Recent developments in the financing of manufactured homes have the potential to drive this growth even further. Traditionally, borrowing for manufactured housing has been considerably more difficult and expensive than for site-built homes, with buyers forced to take chattel loans rather than mortgages to fund their purchases. The widely-held presumption was that these assets would depreciate, rather than appreciate in value.

Source: United States Census Bureau, July 2018; United States Census Bureau, December 2017. Charts: Sun Communities, November 2018.

However, continually improving offerings from manufacturers and a change in policy direction by the US Government have turned that model on its head. In December 2016, the Federal Housing Financing Agency (FHFA) issued Fannie Mae and Freddie Mac with a “duty to serve under-served markets”, including manufactured housing, and the two government-sponsored mortgage buyers have begun to expand their reach into the manufactured housing market, driving down interest rates for borrowers. At the same time, new analysis of repeat-transaction prices by the FHFA indicates that manufactured housing may actually appreciate in a similar manner to site-built homes5.

While demand for shipments remains high, so too will demand for land and facilities to accommodate them. REITs with assets concentrated in residential parks, like the AMP Capital Global Property Securities Fund, which is an active ETF trading on the Australian Stock Exchange, gain from exposure to market upside with low overheads, such as maintenance and customer turnover, compared to traditional property assets. In addition, the reluctance of local authorities to approve new residential park developments (only ten were approved nation-wide in the US in 2017) means that constrained supply is likely to preserve or increase the value of these investments for some time to come.

With options like vaulted ceilings, walk-in wardrobes and built-in fireplaces widespread across the industry, manufactured homes have well and truly shed any lingering association with the trailer park and have become a solid option for first home buyers and retirees alike. There’s a reason Warren Buffet has a large stake in the sector and why the legendary real estate investor Sam Zell continues to promote the view that this truly is an institutional real estate sector – put it down as one to watch over the next few years.

1 Equity LifeStyle Properties, Investor relations presentation, February 2019.

2 United States Census Bureau, Manufactured Housing Survey Data, February 2019.

3 United States Census Bureau, New Residential Sales.

4 United States Census Bureau, Average sales price of new manufactures homes, June 2018.

5 Federal Housing Finance Agency, House Price Index, August 2018.

Important notes

This advertisement has been prepared by AMP Capital Investors Ltd (ABN 59 001 777 591, AFSL 232497) (“AMP Capital”). BetaShares Capital Ltd (ACN 139 566 868, AFSL 341181 (“BetaShares”) is the responsible entity and the issuer of units in the AMP CAPITAL GLOBAL PROPERTY SECURITIES FUND (UNHEDGED) (MANAGED FUND), (each a “Fund”). AMP Capital is the investment manager of the Funds and has been appointed by the responsible entity to provide investment management and associated services in respect of the Funds. Investors should consider the Product Disclosure Statement (PDS) for the relevant Fund before making any decision regarding the Fund. The PDS contains important information about investing in each Fund and it is important investors read the PDS before making a decision about whether to acquire, continue to hold or dispose of units in the Funds. Past performance is not a reliable indicator of future performance. Neither BetaShares, AMP Capital, nor any other company in the AMP Group guarantees the repayment of capital or the performance of any product or any particular rate of return referred to in this information. This information has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. Investors should, before making any investment decisions, consider the appropriateness of this information, and seek professional advice, having regard to their objectives, financial situation and needs.