If you’re an American, you’re much more likely to rent your home or apartment today than you were ten to twenty years ago. If Seinfeld were filmed today, Jerry would still be renting his apartment on the Upper West Side of Manhattan, rather than owning it.

A slump in home ownership in the United States is a trend that investors of all sizes can tap into and benefit from.

A larger pool of renters is good news for companies that specialise in owning and leasing apartments. There is a group of high-quality US apartment REITs that benefit from the renting trend, and provide a good opportunity for Australian investors to gain exposure to the growth in US rentals, to generate income streams, and to achieve offshore diversification in their property portfolio.

The influence of Millennials

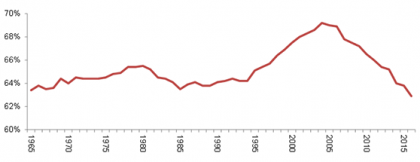

As shown in Figure 1 below, US homeownership has fallen steadily since the Global Financial Crisis (GFC) to a level not seen since Lyndon B. Johnson occupied the White House 50 years ago.

Figure 1: US homeownership rate (1965 to 2016)

Source: US Census Bureau

During the GFC, home ownership in the US fell as many Americans struggled to service their home loans.

As the economy improved, you may have expected this trend to revert – however, the slump in home ownership has continued. One explanation is that the tarnished credit records suffered during the GFC still haunt some borrowers who remain locked out of the mortgage market. Banks – under greater regulatory scrutiny – have also tightened loan requirements.

But there is another explanation for the sustained drop in home ownership: the preferences of Millennials (those born between 1980 and 2004).

Millennials now make up the largest share of the American workforce, a proportion which is set to rise to 75 per cent by 2025. As the largest source of new demand for housing, be it home sales or rentals, this cohort wields significant influence over the residential real estate market.

Millennials want to rent. This should come as no surprise. After all, this is the generation that pioneered and embraced the “sharing economy”, a collaborative approach to consumption that draws heavily on the notion of renting.

Millennials are marrying later in life; prefer proximity to nightlife and the workplace; seek flexibility as they switch jobs readily; and are struggling to save for down payments. These factors combined contribute to a greater tendency to rent.

As a result, there has been an increase in demand for rented apartments, particularly in what is dubbed the ‘urban core’: areas of high density in and around city centres.

The impact on the apartment business

With renting being both more acceptable and common, there are meaningful implications for real estate assets. Clearly, the movement of the prime renter demographic into the city centre will have an impact on apartment values.

A bigger pool of renters means a more stable business. An increasingly older tenant base (Millennials rent later into life) should also allow for healthier rent increases.

Lastly, because of land and development constraints in dense, urban areas – which will become increasingly more onerous over time – existing high quality, core product will be at an advantage.

Exposure through US apartment REITs

Broadly, this change in American dwelling habits is a positive for residential landlords. Investors can gain exposure to that upside potential through the listed institutional apartment operators.

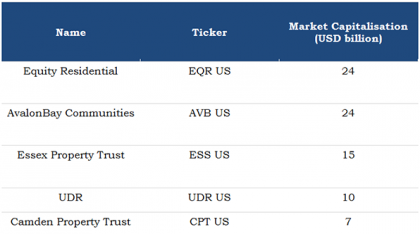

These apartment (Real Estate Investment Trusts) REITs are generally of high quality and have seen significant consolidation in recent times – five such REITs have been acquired or have merged during the past three years alone – leaving an investible set of large, well-capitalised companies with seasoned management teams, as shown in Figure 2.

Figure 2: Largest US Apartment REITs by Market Capitalisation

Source: Bloomberg, as at December 2016

The listed apartment REITs’ assets are predominantly located in the urban core, where renting is most common and where further development is increasingly difficult. A greater focus on public transportation links should further benefit the high-quality apartment names.

As always, expertise counts when identifying those companies with best-of-breed management teams and asset portfolios in order to deliver an attractive, long-term real estate return.

Investors should therefore consider dedicated listed real estate managers with on-the-ground coverage and the ability to tap into local market insight, to deliver a conviction portfolio of liquid, high-quality real estate.

A more attractive through-cycle investment

The emergence of the Millennials as the single largest demographic in the United States, accounting for an ever-growing proportion of the American workforce, has brought with it a shift in the value paradigm driving residential real estate consumption.

Affordability challenges and demographic change have resulted in a larger share of the population living and renting in the city centre. Over the property cycle, the US apartment REITs should therefore be in a stronger position to push rents, given the larger demand base. Quality management teams with insight into the needs of Millennials will be best placed to deliver value for investors.

This is not to say that the US apartment REITs will always outperform. Indeed, there will be times when better opportunities present themselves, particularly if investing across the global listed real estate universe.

However, we believe that this subsector is a more attractive through-cycle investment because of the structural tailwinds described above.

This article was based on the ‘Generation Rent: The symbiosis of apartment REITs and Millennials’ whitepaper which can be downloaded here.

Source: AMP Capital 12 April 2017

Client Portfolio Manager, Global Listed Real Estate at AMP Capital

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.