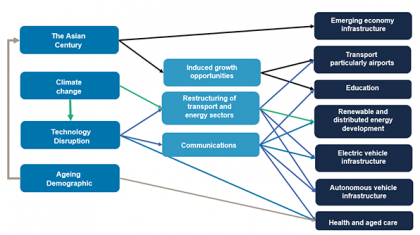

Infrastructure investing is changing fast as evolving global trends throw up new opportunities.

The rise of emerging Asian economies, climate change, technological disruption and the ageing demographic are transforming the demand for essential facilities across the developed world and beyond.

This is creating exciting investment opportunities for infrastructure investors who are examining this expanding asset class to capture global economic growth.

Source: AMP Capital

The Asian Century

The Chinese middle class has expanded enormously in recent years; from just 4% of its population in 2000, it is expected to reach 75% by 2022 according to McKinsey. Similar trends are becoming evident in India and south-east Asian economies. According to PwC, six of the world’s seven largest economies in 2050 will be current emerging economies; three of the top four being in Asia.

This is already fueling the infrastructure needs of those societies, as evidenced by the Chinese government’s One Belt One Road initiative. Fast rail links, the Hong Kong-Zhuhai-Macau Bridge and upgraded port facilities are all signs of this.

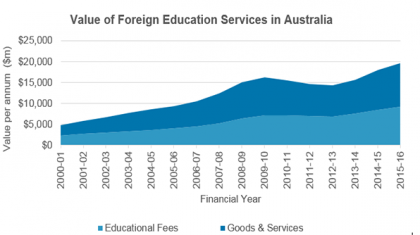

This trend is also impacting developed economies as the Asian middle class spends its new wealth in western countries. A university education in an English-speaking developed country is highly regarded across Asia. Education is now Australia’s largest service export.

This influx of international students is increasing the need for student accommodation attached to leading universities in countries such as Australia. This market expects a higher quality standard than traditional student housing, but its enhanced ability to pay gives rise to long-term high-yield investments that provide protection against inflation.

Source:ABS 5368.0.55.003

The emerging Asian middle class is also spending its new-found wealth on overseas travel. Long-haul air travel in the Asia Pacific region is forecast to grow in excess of 6% per year over the next 20 years.

Australian international airports have taken advantage of this, achieving some of the highest EBITDA growth amongst developed economy airports. A lack of spare capacity and technological improvements that enable more long-haul direct flights are boosting demand for new infrastructure projects to support this growing demand.

Climate change

The 2015 Paris Climate Change Agreement committed countries to take measures that would limit global warming to 2 degrees Celsius. This promise and the immediate impact of pollution are leading to the restructuring of transport and energy sectors.

Road congestion and pollution are leading to electric vehicles, greater experimentation with road charging, high-speed rail links and the expansion of mass transit networks in large urban areas. Such developments require large-scale construction projects and/or the handling of large volumes of data.

Climate change has also led governments to adjust the incentives that apply to energy supply in favour of renewables at the expense of fossil fuels. The profusion of wind, solar, hydro and tidal projects is well-established, however these are likely to continue to expand as their historic cost disadvantage continues to diminish.

Climate change also represents a challenge for the management and distribution of scarce urban water resources, in which private sector capital may well have a role to play.

Disruptive technology on a micro level is leading to energy cost savings for households when rooftop solar panels are integrated with advanced battery technology and connected to the electricity grid. Individual households have achieved cost savings in excess of 80% of their annual electricity bills through exploiting this technology.

Technology costs are expected to continue to fall, making such systems increasingly viable for the typical home owner. Furthermore, integration with network operations can improve grid productivity and also opens up an alternative power generation opportunity for infrastructure investors.

Technological disruption

Technological disruption is initiating a fourth industrial revolution as devices become automated and connected.

The decentralisation of work, energy and service provision is leading to more home working, energy self-sufficiency and local/home delivery. However these trends require ongoing investment in the data and logistical infrastructure required to support these lifestyle shifts.

Hybrid and electric cars and delivery trucks are already becoming a common sight across developed countries. Electric vehicles will be cheaper for consumers and permit the decarbonising of the transport sector.

Looking further ahead, automated vehicles (which will be overwhelmingly electrically-powered) will eventually deliver a more flexible alternative to conventional public transport methods and private car ownership.

However this will depend upon massive infrastructure capex to support the power and data transmission that will be required for the safe and reliable use of road space.

Ageing Demographic

Global fertility rates have halved since 1955 as much of the world has industrialised and life expectancy has risen in developing countries. However the demographic deficit is impacting low-nominal growth developed countries such as Japan and Italy as well as Russia and China. The size of Japan’s workforce has been declining since 1994 as demographics meet a cultural hesitation towards immigration.

This trend is leading to greater health spending; in the UK some 40% of the state-financed National Health Service is spent on the over-65s, a proportion that will continue to rise. Longer-term aged care facilities will also continue to see increasing demand.

These trends will lead to ongoing infrastructure capex as new facilities are established by both public and private sector providers.

Conclusions

A broad range of high-growth infrastructure investments will be generated by these major global structural themes.

Opportunities are most likely to arise in the transport, energy, data/communications and healthcare sectors.

While some of these opportunities, such as airports, will be quite familiar, others will be new, including disruptive technologies or those found in emerging economies. Sovereign and governance risks in these economies will require careful management and the selection of local partners.

These emerging opportunities will provide infrastructure investors with potentially higher returns (and potentially higher risks) which will complement conventional infrastructure investments. Success will depend upon good project selection and high levels of positive control to allow active ‘private equity-style’ asset management of investments.

The blending of higher return “new infrastructure” and traditional infrastructure will allow portfolio managers the ability to construct portfolios with a wide range of risk and return characteristics.

Source: AMP Capital 13 June 2018

Author: John Julian, Portfolio Manager, Core Infrastructure Fund

Important note: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided.