There are mechanisms to maximise returns in this lower-for-longer environment, and a green alpha strategy in real estate investment is one option on the table.

Against a global backdrop of lower interest rates, falling government bond yields and bank term deposit returns at or below 2 per cent, achieving higher, low risk returns is becoming more challenging for investors.

With the lower for longer trend seemingly entrenched as global economic uncertainty rises, investors are turning to green alpha strategies as one way to maximise returns, whilst improving the sustainability performance of Australia’s built environment at the same time.

How does this apply to real estate?

From a real estate perspective, maximising the returns you can generate in a portfolio is primarily linked to boosting the rental income and keeping operational costs down. Reducing the outgoings of an asset by cutting energy costs is an important, and relatively simple method to boost income yields and according to market evidence and international studies into green buildings, can make significant differences to the return an asset delivers over its life.

Asset valuations and returns are already starting to reflect a growing divergence between high-standard green buildings and their less green peers that can add as much as 50bps per annum to a total return.

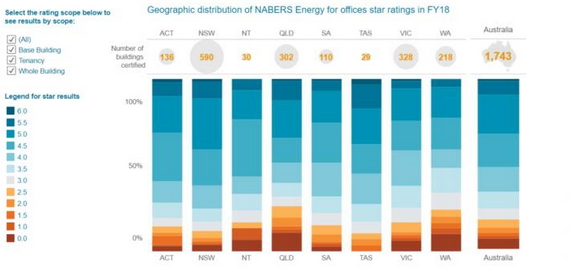

For example, according to the MSCI Green Property Investment Digest, over the past three years, Prime CBD Office buildings with a NABERS star rating higher than four stars (the maximum is six) have delivered a total return to their investors of 13.4%, versus 12.9% for all other assets in this category.

Source: NABERS.gov.au

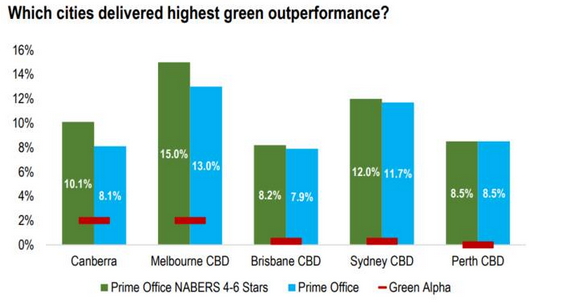

Looking at a cities level, investors chasing green returns might do well to focus on the Melbourne market, which had the highest total returns for prime office buildings with a 4-6 star NABERS rating at 15% in the year to June 2019.

After Melbourne, investors in Canberra benefitted from the highest ‘green alpha’ with a 200 basis point boost in total returns, versus the average for the prime office market there. Government tenants in this market place a high priority on green credentials when leasing space, driving better income return outcomes for landlords who can offer 5 star plus opportunities in that market.

Source: MSCI/IPD, AMPCI RE Research

Thinking long term, and looking beyond cost savings, sustainability initiatives such as integrated solar in commercial assets can provide long term downside protection against spikes in electricity costs. These sort of initiatives could reduce the outgoings of an asset, a competitive advantage at a time where electricity prices have risen by over 20% in the past two years.1

Green alpha and the boost it provides to total returns has become a bigger part of an asset manager’s toolkit in maximising returns. Greener buildings, apart from delivering superior returns, tend to offer investors lower systemic risk with a more stable income profile, lower incentives and enhanced tenant “stickiness” which can reduce the vacancy of a portfolio.

The bottom line is, environmentally sustainable buildings offer both financial and environmental benefits to investors for the long term. In an increasingly challenging lower for longer returns environment, green alpha is a pathway to get ahead of the pack.

1 https://www.nabers.gov.au/publications/annual-report

Author: Luke Dixon, Head of Real Estate Research – Real Estate Sydney, Australia

Source: AMP Capital 28th Oct 2019

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.